No Knock-Out at The Bell

As we announced in late April, the U.S. Department of Labor (“DOL”) established new minimum compensation amounts effective July 1, 2024, for salaried employees in bona fide executive, administrative, or professional positions. It was widely expected that litigation would be commenced immediately to keep the new levels from being implemented and, indeed, three lawsuits were filed in Texas claiming the DOL exceeded its authority in establishing the salary levels. Two of the lawsuits sought a nationwide injunction to prevent the new levels from going into effect. Defying expectations, none of the claims delivered the requested knockout punch preventing the new levels from going into effect. The only injunction issued came in the case of State of Texas v. U.S. Dep’t of Labor in which the Judge prevented the DOL from enforcing the increases as they relate to Texas government employees.

The Fight Goes On

While the bell has been rung for the implementation of the new salary rules, the fight is going into extra rounds. The Judge in the State of Texas case expects to rule on the final merits of the claim in a matter of months while a case pending in the U.S. Court of Appeals for the Fifth Circuit, Mayfield v U.S. Department of Labor involves the issue of whether even the current salary levels are enforceable. Oral arguments are expected in that case on August 7, 2024. Developments in either of these cases could result in the newly implemented minimum salary levels being set aside. Further attacks on the new standards are also expected considering the Supreme Court’s ruling last Friday in Loper Bright Enters v Raimondo which overruled the long-standing Chevron doctrine of deference to rules promulgated by federal agencies. Accordingly, the status of the new salary levels could literally change any day. In any event, it is likely there will be more clarity before the very significant changes slated to go into effect on January 1st are implemented.

What Employers Should Do Now

For the time being, the new minimum salaries are in force for all employers except for the State of Texas. Accordingly, they should be implemented if you want to maintain employees earning less than the new levels as salaried exempt employees. Alternatively, employers can leave pay levels where they are and reclassify salaried employees whose pay rate is below the new salary level as nonexempt or take steps to limit their work schedule to 40 hours per week (and document their compliance through a timekeeping system) to avoid overtime obligations. In either case, if they exceed 40 hours, overtime should be paid. Given the expense of complying with the new rates and all the legal uncertainty, the best short-term approach may be to limit all work over 40 hours per week for employees that would receive the increased levels for the next few weeks to see if further bouts in the fight drop the new standards to the floor. Since most employers pay bi-weekly, they should have a week or more to determine the best approach. Taking no action runs the risk of claims by impacted employees or the Department of Labor seeking unpaid overtime along with statutory penalties and attorney fees.

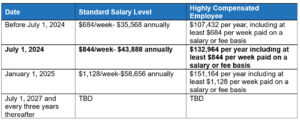

A Reminder of the New Levels

The minimum salary is required to be paid to those exempt from overtime and minimum wage because they are in a bona fide executive, administrative, or professional capacity within the employer’s work force. There is also an overtime exemption for certain highly compensated employees who are paid a salary, earn above a higher total annual compensation level, and satisfy a minimal duties test. As noted in April, the changes are significant. Here’s a simple chart:

What to Do if the New Levels Withstand the Legal Challenges

The salary-exempt rules require that salaried employees meet both the salary and duties tests. While there are a lot of benefits to both employers and employees of payment based on a salary (no need to keep track of time, work assignments that cannot be accomplished in 40 hours, a certain prestige within the organization, etc.) it may be that it makes more economic sense to recategorize some employees as non-exempt hourly workers with overtime paid for work over 40 hours. If your salaried workforce regularly works in the 40 hour and under range, you can pay a lot of overtime for the difference between their current salary and the new base rates.

The Rhoades McKee Employment Law Team is available to discuss how you should best navigate the tricky path forward as it relates to the new DOL minimum salary standards.

More Publications